A Landmark in India’s Banking Recovery

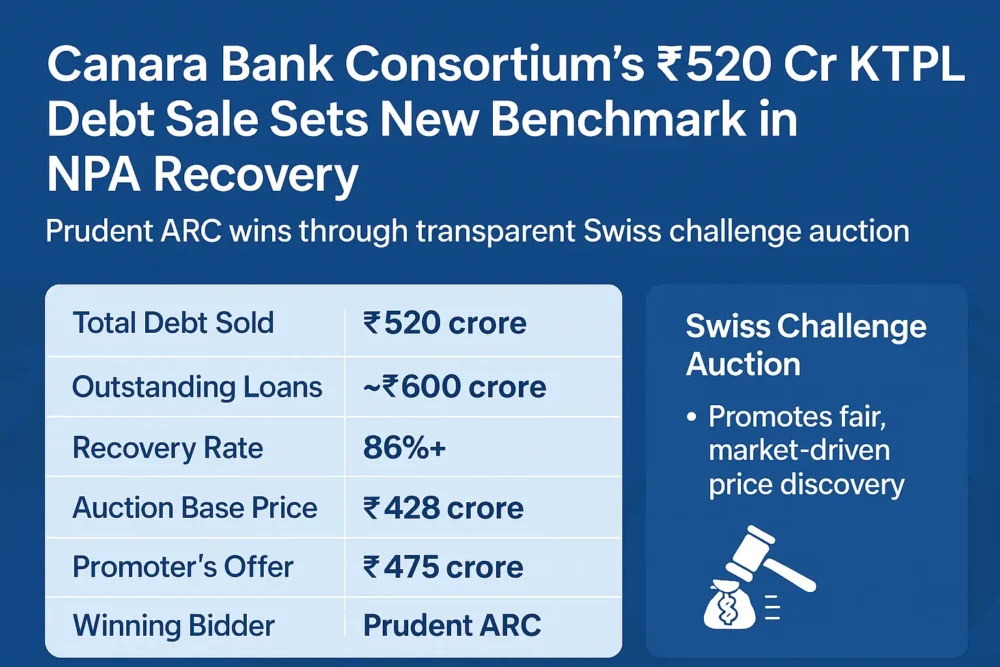

The Indian banking sector marked a major milestone as a Canara Bank-led consortium successfully sold Karanja Terminal and Logistics Pvt Ltd (KTPL)’s ₹520 crore debt to Prudent Asset Reconstruction Company (ARC). Conducted via a transparent Swiss challenge auction, this transaction achieved over 86% recovery, one of the highest ever recorded in an NPA sale.

🔗 Reference: Reserve Bank of India – Guidelines on Asset Reconstruction

💰 Transaction Snapshot

| Particulars | Details |

|---|---|

| Total Debt Sold | ₹520 crore |

| Outstanding Loans | ~₹600 crore |

| Recovery Rate | 86%+ |

| Auction Base Price | ₹428 crore |

| Promoter’s Offer | ₹475 crore |

| Winning Bidder | Prudent ARC |

The final bid of ₹520 crore exceeded the base price by ₹92 crore and surpassed the promoter’s settlement offer by ₹45 crore — underscoring strong competition and investor confidence.

⚖️ Transparent Swiss Challenge Auction: A Game-Changer

The Swiss challenge mechanism ensured a fair, market-driven price discovery process. Prudent ARC’s initial ₹465 crore offer became the benchmark, later countered and raised to ₹520 crore through open bidding.

Key Benefits for Lenders:

- Maximized loan recovery

- Encouraged competitive bidding

- Enhanced transparency

- Created a new valuation standard for distressed assets

🔗 Learn more: Insolvency and Bankruptcy Board of India – Market-Based Resolution Framework

⚖️ Legal Context and Ongoing Proceedings

KTPL’s promoters have contested the debt sale, citing prior settlement compliance and delays in consortium approvals. The Delhi High Court declined interim relief, and the case remains sub judice.

Despite the pending litigation, banking experts view the KTPL case as a milestone in proactive NPA resolution, demonstrating lenders’ readiness to pursue open-market recovery methods.

🔗 Court Reference: Delhi High Court Case Status

🏗️ KTPL: Strategic Infrastructure Asset

Karanja Terminal and Logistics Pvt Ltd operates a key port terminal in Raigad, Maharashtra, catering to industrial and cargo hubs near Navi Mumbai. Its strategic location and long-term growth potential made the asset attractive for multiple institutional bidders, contributing to the high final valuation.

🔗 Industry Context: Ministry of Ports, Shipping and Waterways

🔍 Swiss Challenge Auctions in NPA Recovery

A Swiss challenge auction invites counter-bids against an existing offer. The highest counter-bid sets the new price, and the original bidder can match it to retain the deal. This system enhances competition, fairness, and lender returns, reducing subjective deal-making.

Advantages for Banks & ARCs

- Transparent and auditable bidding

- Better value realization for distressed loans

- Greater participation from institutional investors

- Minimizes insider negotiations

🔗 Policy Reference: RBI Framework for Sale of Stressed Assets

🏦 Implications for Indian Banking Sector

The KTPL transaction serves as a template for future NPA resolutions, proving that transparent price discovery can deliver better recovery outcomes than closed-door settlements.

Sectoral Takeaways

- Validates competitive auction methods

- Boosts investor confidence in ARCs

- Encourages collaboration among lenders

- Sets recovery rate benchmarks for large NPAs

With more banks now exploring similar approaches, the KTPL case could drive systemic improvements in India’s stressed asset ecosystem.

🔗 Background Reading: Financial Stability Report – Reserve Bank of India

📈 Outlook: Redefining NPA Resolution Frameworks

The Canara Bank-led KTPL debt sale has redefined how NPAs can be recovered efficiently and transparently. As courts finalize the legal proceedings, the success of this transaction is likely to encourage:

- More Swiss challenge auctions in the ARC sector.

- Greater private capital participation in distressed debt.

- Enhanced market confidence in India’s resolution ecosystem.

This case highlights how structured competition and transparent valuation can strengthen India’s financial stability while protecting taxpayer-backed banking systems.

For more such updates and latest news on cars and bikes stay connected to times.motormitra.in

Thank you ..

Motor Mitra

For more such updates and latest news on cars and bikes stay connected to motor mitra

Thank you ..