India Halts Russian Oil Imports Amid US Sanction

In a major realignment of India’s energy sourcing strategy, five of India’s largest oil refiners have stopped buying Russian crude for December, marking a sharp policy shift driven by US sanctions and ongoing trade deal negotiations with Washington. The decision — by Reliance Industries, Bharat Petroleum, Hindustan Petroleum, Mangalore Refinery and Petrochemicals (MRPL), and HPCL-Mittal Energy — effectively pauses two-thirds of India’s Russian crude intake for next month.

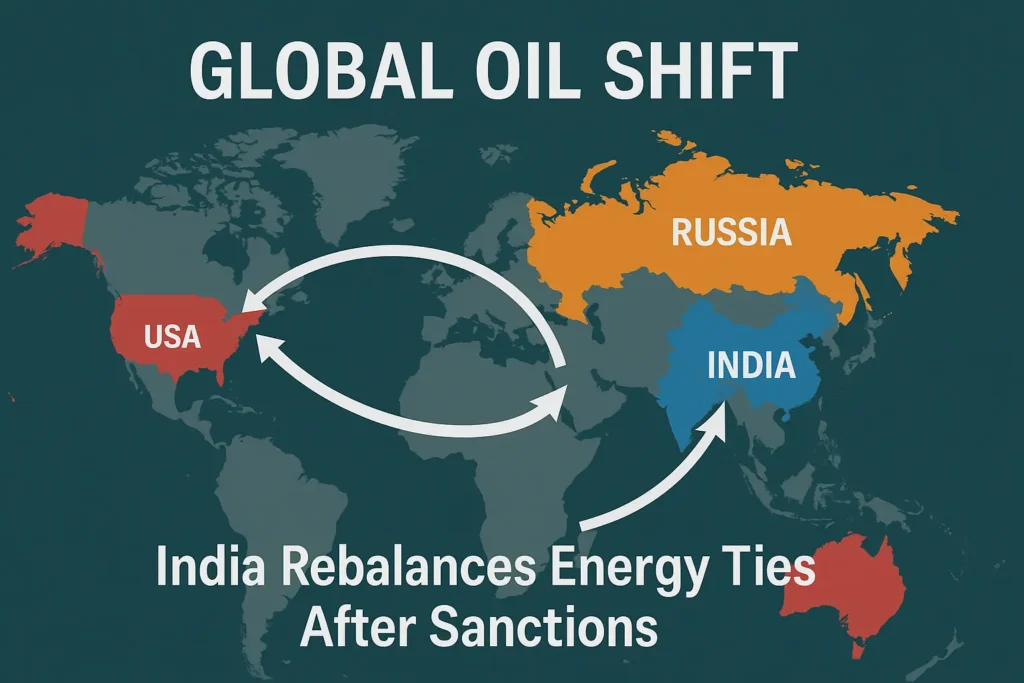

This development comes as Washington tightens sanctions on Russian oil giants Rosneft and Lukoil, and as New Delhi seeks to balance its energy needs with evolving geopolitical and trade pressures.

US Sanctions Trigger the Pullback

The immediate catalyst for the halt is the October 22 US sanctions against Rosneft and Lukoil, Russia’s two largest oil producers. The sanctions mandate that all transactions with these firms must cease by November 21. Compounding this, US President Donald Trump’s decision in August 2025 to double tariffs on Indian imports from 25% to 50% has intensified trade tensions. During a White House briefing earlier this week, Trump remarked:

“India has stopped doing the Russian oil. We’re pretty close to reaching a trade deal, and we’ll bring the tariffs down at some point.”

The US has long urged India — the world’s third-largest oil importer — to reduce its dependence on discounted Russian crude, especially amid the ongoing war in Ukraine and tightening sanctions against Moscow.

Also Read – PM Modi Unveils ₹150 Silver Coin & Stamp Honoring Sardar Patel

🇮🇳 Refiners Adjust Strategy

According to industry sources, the five refiners have not placed any orders for Russian oil for December. Collectively, they represent around two-thirds of India’s total Russian imports this year. Only Indian Oil Corporation (IOC) and Nayara Energy have continued Russian purchases:

- IOC has sourced about five cargoes from non-sanctioned Russian entities.

- Nayara Energy, which is 49.13% owned by Rosneft, remains heavily reliant on Russian crude.

Russia’s share in India’s oil basket — which had surged to 36% in 2025 — is now expected to shrink significantly as refiners diversify their crude sources.

Trade Negotiations Drive Policy Shift

The freeze on Russian crude aligns with US-India trade deal negotiations currently underway. To demonstrate goodwill, India has increased crude imports from the United States, which hit 568,000 barrels per day in October, the highest since March 2021. Analysts expect these volumes to normalize between 250,000 and 350,000 barrels per day in the coming months as both sides finalize trade terms.

Trump’s administration has tied tariff reductions to India’s compliance with US foreign policy objectives — particularly regarding energy trade and strategic alignment in the Indo-Pacific region.

Also Read – Reliance, Meta Launch $15B AI Push 2025

Middle East Steps In to Fill the Gap

With Russian barrels on hold, Middle Eastern suppliers have stepped up.

Saudi Arabia, Iraq, and Kuwait have allocated full-term crude volumes to Indian refiners for December and are offering additional supplies through optional contracts. Executives from Saudi Aramco and Abu Dhabi National Oil Company (ADNOC) met with Indian state refiners at an energy summit in Abu Dhabi last week, assuring stable and flexible supply commitments. This renewed focus on the Middle East echoes India’s pre-Ukraine energy mix, when Gulf producers dominated its import basket.

Market Impact and Oil Price Dynamics

The global oil market is entering a phase of potential oversupply as Western demand slows and inventories rise.

- Russian crude discounts have widened to $4 per barrel below Brent, the steepest in nearly a year.

- Despite the discounts, refiners are avoiding purchases to prevent secondary sanctions or financial penalties tied to US restrictions.

Analysts expect the short-term impact on pump prices in India to be minimal, as refiners had already secured term contracts with Middle Eastern suppliers through early 2026. However, if geopolitical tensions escalate, costs could rise in the medium term.

Strategic Implications for India

India’s decision to halt Russian crude imports signals a strategic recalibration of its foreign policy — balancing energy security with diplomatic pragmatism.

While Russia had emerged as India’s top oil supplier after the Ukraine war, US sanctions and trade negotiations are pushing New Delhi back toward traditional partners. Energy analysts suggest that this could also open doors for increased US investments in India’s downstream oil and gas sector, aligning with Washington’s broader goal of deepening energy cooperation with democratic allies in Asia.

Also Read – Bharat Taxi Launch 2025: India’s New Ride App to Rival Ola & Uber

Key Takeaways

- Five major refiners (Reliance, BPCL, HPCL, MRPL, HMEL) halted Russian crude orders for December 2025.

- US sanctions on Rosneft and Lukoil effective Nov 21 forced compliance.

- Trump administration signals progress on US-India trade deal.

- Middle East suppliers (Saudi, Iraq, Kuwait) fill supply gap.

- Russian discounts widen to $4/barrel below Brent amid falling demand.

India’s decision to halt Russian oil imports underscores a turning point in its energy diplomacy. As US-India trade negotiations advance and sanctions tighten, New Delhi appears to be recalibrating its import strategy to safeguard both its economic interests and global partnerships.

In the short term, Middle Eastern suppliers and US crude will offset the Russian vacuum. But in the long term, this move reflects India’s bid to balance strategic autonomy with pragmatic alignment in a multipolar energy world.

Thank you for reading. Don’t forget to subscribe for more coverage on women’s sport, cricket breakthroughs and Indian sporting milestones.