SBI to Modernize Core Banking Systems

📅 Published: November 14, 2025 | Source: Times.Mitra.in

India’s largest public sector lender, the State Bank of India (SBI), has announced a sweeping plan to modernize its core banking systems within two years, targeting full implementation by the end of fiscal year 2028.

Speaking at the Singapore FinTech Festival 2025, Ashwini Kumar Tewari, Managing Director of SBI, unveiled the bank’s four-axis digital transformation roadmap, aimed at revamping its legacy infrastructure while ensuring uninterrupted banking services to over 500 million customers globally.

The move represents one of the largest digital modernization programs in India’s banking history, reinforcing SBI’s intent to remain competitive in an era of rapid fintech disruption and AI-led innovation.

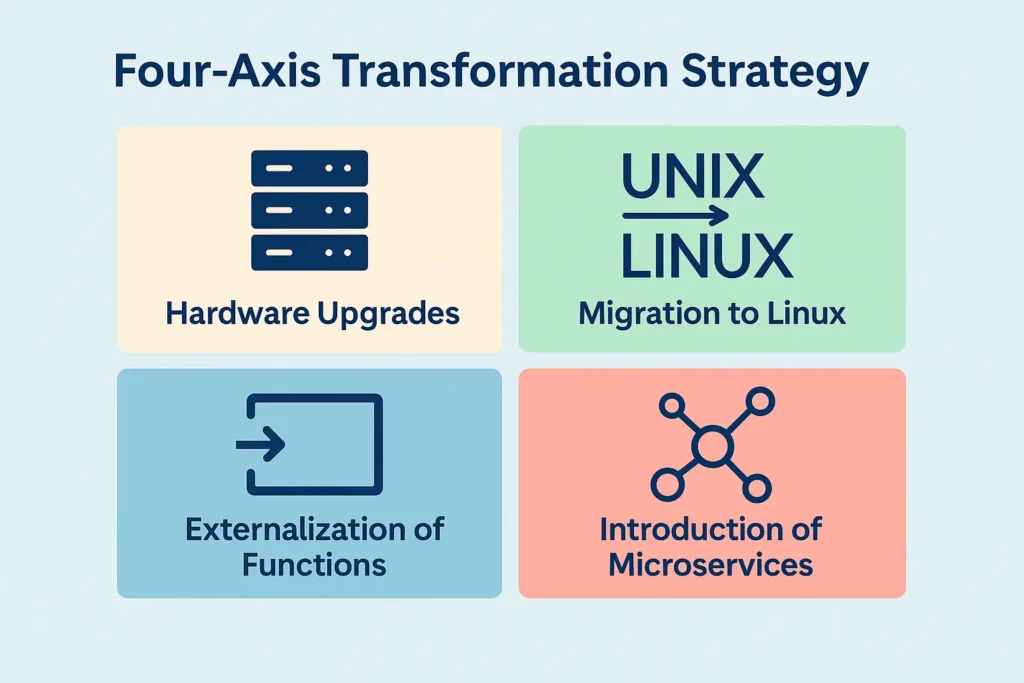

Four-Axis Core Modernization Strategy

SBI’s modernization initiative is structured around four strategic pillars, designed to upgrade the bank’s technological backbone and future-proof its services for the next decade.

1️⃣ Hardware and Infrastructure Overhaul

SBI is upgrading its data centres and high-performance computing systems, ensuring greater reliability and scalability.

The bank is migrating its legacy systems from proprietary Unix-based servers to open-source Linux platforms, reducing vendor dependency while enhancing flexibility and cost efficiency.

This migration also opens doors for faster interoperability with fintech platforms, allowing SBI to integrate new-age digital solutions seamlessly.

“We are modernizing as we run the ship. Our systems must always remain on and available to customers,”

said Ashwini Kumar Tewari, emphasizing SBI’s “zero downtime” philosophy.

Also Read – RBI HaRBInger 2025 Hackathon | Secure Banking Innovation

2️⃣ Functional Externalization and Microservices

The bank is externalizing non-core functions like vendor management, government payments, and service routing.

At the same time, it is introducing microservices for modular banking operations — covering areas like accounting, reconciliation, and inquiry systems — which can be upgraded independently without affecting customer-facing platforms.

3️⃣ Private Cloud Deployment

SBI is building its own private cloud infrastructure, enhancing data security, compliance, and scalability.

This internal cloud setup will enable the bank to host critical workloads safely, handle large-scale digital transactions, and improve operational efficiency.

4️⃣ Fintech and API Integration

Through its innovation hub and open API ecosystem, SBI is enabling real-time fintech collaboration — effectively transitioning from a traditional bank to a digital-first financial platform.

AI Deployment: From Trade Finance to Document Automation

As part of its digital leap, SBI is now deploying agentic AI systems through a fintech partnership.

These AI solutions are being used to verify trade finance documents like letters of credit, guarantees, and bill collections — enabling faster turnaround times for both customers and internal teams.

AI use cases under active deployment include:

- Automated trade document verification

- AI-driven ticket resolution for customer service

- Optical Character Recognition (OCR) for document validation

- Predictive analytics for detecting operational inefficiencies

These tools are expected to reduce manual verification time by 60%, drastically improving the bank’s productivity and decision accuracy.

“Artificial intelligence isn’t just a buzzword — it’s becoming an operational reality,” Tewari stated, hinting at further AI adoption in risk management, customer onboarding, and credit analysis.

Also Read – Neeraj Chopra Territorial Army Honour | Lieutenant Colonel Rank

Fintech Collaboration: From Competition to Co-Creation

In a marked shift from the traditional bank-versus-fintech rivalry, SBI has adopted a collaborative approach.

The bank’s innovation sandbox, launched in partnership with APIX (Singapore’s fintech exchange), now offers over 300 APIs for fintech developers.

These APIs enable startups and digital partners to test, validate, and integrate their products with SBI’s systems — a move that accelerates co-innovation and solution deployment.

Initially launched with 250 APIs in 2024, the innovation hub has since expanded to include APIs for:

- Digital lending

- KYC verification

- Payments & settlement

- Account aggregation

- Cross-border remittances

Tewari emphasized the scale challenge as a key consideration:

“Along with agility, convenience, intuitiveness, interface, security, and compliance, the ability to meet the scale of SBI’s operations is a crucial parameter for fintech onboarding.”

This strategy reflects SBI’s goal of becoming India’s most open and collaborative financial institution while maintaining strict regulatory alignment with RBI guidelines.

Why This Transformation Matters

SBI’s ongoing digital modernization has implications that go beyond one bank — it could reshape how India’s banking sector approaches core infrastructure upgrades.

Key benefits expected from the overhaul include:

✅ 24×7 service uptime through hybrid cloud infrastructure

✅ Reduced operational costs due to open-source migration

✅ Faster fintech integration via APIs and modular microservices

✅ Improved cybersecurity and compliance standards

✅ Enhanced AI-based automation for back-office efficiency

The transformation aligns with India’s national fintech vision to digitally empower 1.4 billion citizens and strengthen the Digital India Mission’s financial backbone.

SBI’s Tech Vision for FY2028

| Focus Area | Implementation Timeline | Strategic Impact |

|---|---|---|

| Unix → Linux Migration | By FY2026 | Reduced vendor lock-in, improved scalability |

| Private Cloud Rollout | FY2026–27 | Secure hosting & compliance |

| AI Trade Document Verification | FY2026 | Faster trade finance processing |

| 300+ Fintech API Integration | Ongoing | Open innovation ecosystem |

| Core Banking Microservices | FY2028 | Real-time modular banking |

Conclusion

With its two-year modernization roadmap, SBI is setting new standards for digital banking transformation in India.

The bank’s combination of AI, cloud, and open API innovation represents not just an upgrade — but a complete architectural shift designed for the next decade of financial services.

As the 500-million-customer institution evolves, its strategy signals a broader message:

🔹 Indian banking can be both legacy-rich and future-ready.

🔹 Modernization and continuity can co-exist at national scale.

SBI’s transformation could serve as a blueprint for other public sector banks seeking to modernize without disruption.

Thank you for reading. Don’t forget to subscribe for more coverage!