RBI Returns JSF Bank’s Universal Bank Licence Application: What It Means for the Sector

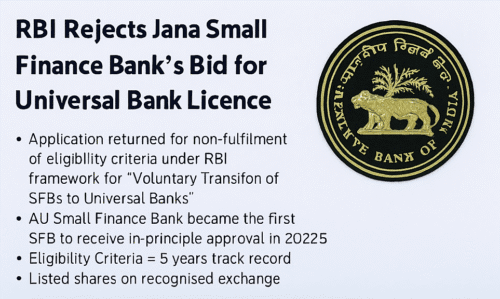

In a significant development for India’s banking sector, the Reserve Bank of India (RBI) has returned the application of Jana Small Finance Bank (SFB), which had sought to transition into a Universal Bank. The RBI’s decision, made under the “Framework for Voluntary Transition of Small Finance Banks to Universal Banks”, cited non-fulfilment of eligibility criteria as the reason.

This move marks a temporary setback for Jana SFB, which has been actively preparing to expand its presence beyond small finance banking.

What Is a Universal Bank Licence?

A Universal Bank Licence allows a financial institution to operate as a full-service commercial bank, providing a wide range of financial services including:

- Retail and corporate banking

- Investment and treasury operations

- International banking services

- Digital and fintech-led financial solutions

For Small Finance Banks (SFBs), transitioning into a Universal Bank is a crucial milestone — it opens doors to larger markets, diversified portfolios, and enhanced credibility.

However, such a transition also brings stricter regulatory oversight, higher capital requirements, and broader operational responsibilities.

Timeline of Key Events

| Date | Event |

|---|---|

| June 2025 | Jana Small Finance Bank submits its application to RBI for voluntary transition to Universal Bank status. |

| October 28, 2025 | RBI returns the application, citing non-fulfilment of eligibility criteria. |

The decision signals the central bank’s cautious and calibrated approach toward granting universal banking licences — especially to smaller, relatively newer entities in the ecosystem.

RBI’s Eligibility Criteria for Transition

As per RBI’s 2024 circular on the “Voluntary Transition of SFBs to Universal Banks,” the following eligibility norms must be satisfied:

- Scheduled Bank Status: The SFB must have held scheduled bank status for at least 5 years.

- Listing: The bank’s shares must be listed on a recognised stock exchange.

- Net Worth: A minimum net worth of ₹1,000 crore in the latest quarter.

- Profitability: The bank must have reported net profits for at least the last two consecutive financial years.

- Asset Quality:

- Gross NPAs must be below 3%

- Net NPAs must be below 1%

for the previous two years.

According to reports, Jana SFB met most of the financial parameters — particularly NPA and profitability targets — but fell short on the scheduled status duration and listing conditions, leading to the application being returned.

AU Small Finance Bank: The Benchmark Case

In contrast, AU Small Finance Bank became the first SFB to receive in-principle approval from the RBI in 2025 to transition into a universal bank.

✅ AU SFB’s Strong Compliance Track Record:

- Scheduled Bank Status: Over 5 years

- Listed Entity: Yes, listed on NSE & BSE

- Net Worth: Exceeded ₹1,000 crore

- Profitability: Consistent profits over multiple years

- NPAs: Maintained well within RBI norms

AU SFB’s case illustrates how consistent performance, early listing, and strong compliance build regulatory trust — setting a benchmark for other SFBs like Jana to follow.

Market Reaction to RBI’s Decision

Following the news, Jana Small Finance Bank’s shares dropped by over 5%, reflecting investor disappointment.

- Previous Day Close: ₹458.85

- Current Price: ₹444.85 (BSE)

This short-term dip indicates market uncertainty, though analysts expect recovery as Jana strengthens its fundamentals.

Jana SFB’s Official Response

Ajay Kanwal, Managing Director & CEO of Jana Small Finance Bank, stated:

“We respect RBI’s decision and will work to fulfil the requirements. Applying for a Universal Banking Licence is a natural progression for Jana. Our mission has always been to serve the underserved and build a bank that’s inclusive, agile, digital, and forward-looking.”

Jana SFB has made it clear that the rejection is not the end, but a pause in its universal banking journey. The bank intends to address the compliance gaps and reapply once the necessary milestones are achieved.

Strategic Implications for Jana SFB

The RBI’s decision underscores the importance of robust governance and regulatory readiness. For Jana SFB, this implies:

- Revisiting its listing strategy to meet stock market norms

- Strengthening its compliance and audit mechanisms

- Maintaining financial stability and improving investor confidence

- Enhancing transparency in reporting and governance

- Building a long-term roadmap for universal banking eligibility

These steps are crucial for Jana to maintain credibility and attract institutional investors for its next growth phase.

For Auto Updates visit – @motormitra

Comparative Snapshot: Jana SFB vs AU SFB

| Criteria | Jana SFB (2025) | AU SFB (2025) |

|---|---|---|

| Scheduled Status Duration | < 5 years | > 5 years |

| Listed on Stock Exchange | No | Yes |

| Net Worth | ~₹1,000 crore | >₹1,000 crore |

| Net Profit (2 Years) | Yes | Yes |

| NPA Compliance | Yes | Yes |

| RBI Approval Status | Application Returned | In-Principle Approved |

This comparison highlights that listing and tenure were the two major differentiators between Jana and AU, influencing the RBI’s final decision.

What’s Next for Jana Small Finance Bank?

Despite the regulatory hurdle, Jana SFB’s long-term prospects remain strong. The bank is likely to focus on:

- Achieving 5-year scheduled status — a key regulatory milestone.

- Pursuing a public listing to strengthen governance and transparency.

- Enhancing capital adequacy and maintaining low NPAs.

- Diversifying product portfolios for broader reach.

- Expanding digital banking services to improve operational efficiency.

Once these milestones are met, Jana will be well-positioned to reapply for universal bank status and continue its growth trajectory. Economic Times – Banking News

Industry Context: Why RBI’s Caution Matters

The RBI’s cautious stance ensures that India’s banking ecosystem remains stable and resilient. By setting stringent eligibility norms, the regulator aims to:

- Prevent premature expansion by underprepared banks

- Protect depositors’ interests

- Ensure financial stability and systemic discipline

- Encourage gradual, sustainable growth in the SFB sector

This move also signals that while innovation and inclusion remain key goals, governance and compliance will continue to be the foundation of regulatory approvals. AU Small Finance Bank – Corporate Announcements

Broader Implications for Small Finance Banks

The Jana case serves as a learning model for other SFBs aspiring to go universal. It highlights:

- The importance of early compliance planning

- The benefits of strong investor governance through listing

- The need for consistent profitability and asset quality

- The role of RBI’s prudence in protecting financial ecosystems

As more SFBs mature, India could see 2–3 more transitions to universal banks by 2027, provided regulatory norms are met. Business Standard – RBI Updates

Conclusion: A Setback, Not a Stop Sign

The RBI’s decision to return Jana SFB’s Universal Bank application is not a rejection of ambition but a reminder of India’s strong regulatory discipline.

For Jana, this is an opportunity to refine its compliance roadmap, strengthen its capital base, and align with RBI’s expectations.

As India’s banking landscape evolves, discipline, transparency, and preparedness will define which institutions graduate to the next level of universal banking.

For more such updates and latest news on cars and bikes stay connected to times.motormitra.in

Thank you ..